Irs tax refund interest calculator

Currently the interest rate the IRS will need to pay is a 4 rate which is likely double your savings account. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Irs State Interest Calculator Tax Software Information

File your tax return on time.

. TaxInterest is the standard that helps you calculate the correct amounts. Interest is taxable income The 2019 refund interest payments are taxable and taxpayers must report the interest on their 2020 federal income tax return. See how your refund take-home pay or tax due are affected by withholding amount.

100 Accurate Calculations Guaranteed. If youre still waiting for a refund it generally will be accruing interest and the rate jumps to 5 on July 1 according to the IRS. Taxpayers who dont meet their tax obligations may owe a penalty.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. The IRS will send a Form 1099-INT. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The IRS charges a penalty for various reasons including if you dont. This 4 interest rate is added quarterly after the initial 45-day. Trial calculations for tax owed per return over 750 and under 20000.

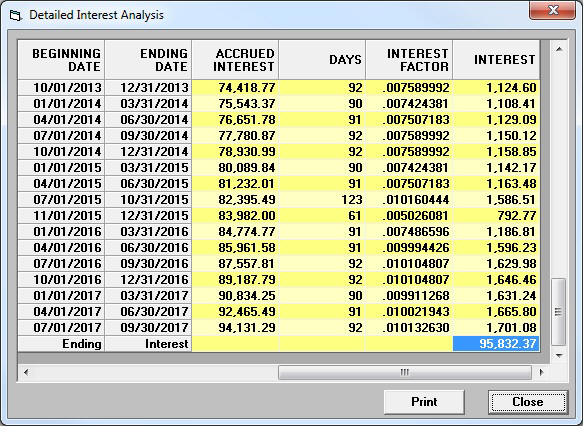

For help with interest. IRC 6621 Interest is computed to the nearest full percentage point of the Federal short term rate. Explanation IRC 6601 a The interest calculation is initialized with the amount due of.

Upgrade to two years for 90. It is not your tax refund. Trial calculations for tax owed per return over 750 and under 20000.

Estimate your federal income tax withholding. Ad Try Our Free And Simple Tax Refund Calculator. Upgrade to two years for 90.

Upgrade to two years for 90. Then select your IRS Tax Return Filing Status. Contact your local Taxpayer.

Restart This Tax Return Calculator will calculate and estimate your 2022 Tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Tax Calculator Refund Estimator for 2022 IRS Tax Returns.

The agency tacks on interest if it. Most IRS tax refunds are issued. Our IRS Penalty Interest calculator is 100 accurate.

Approval and loan amount. Use this tool to. Loans are offered in amounts of 250 500 750 1250 or 3500.

Call the phone number listed on the top right-hand side of the notice. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. This IRS overpayment interest.

This is an optional tax refund-related loan from MetaBank NA. IR-2020-183 August 18 2020 WASHINGTON This week the Treasury Department and the Internal Revenue Service will send interest payments to about 139 million. How It Works.

This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on tax. Up to 10 cash back Use our tax refund calculator to find out if you can expect a refund for 2021 taxes filed in 2022. When will I get my 2021 tax refund.

Our IRS Penalty Interest calculator is 100 accurate. Trial calculations for tax owed per return over 750 and under 20000. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances.

100 Accurate Calculations Guaranteed.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

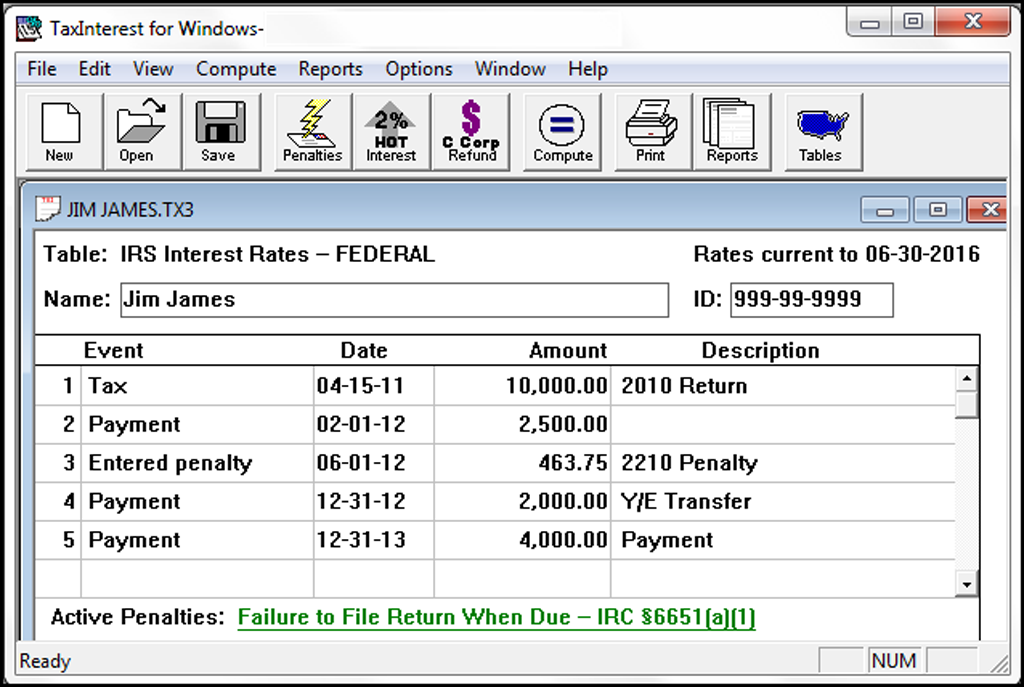

Taxinterest Irs Interest And Penalty Software Timevalue Software

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Easiest Irs Interest Calculator With Monthly Calculation

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

What To Do If You Receive A Missing Tax Return Notice From The Irs

Acortar Maletero Contento Estimated Tax Penalty Calculator Valor Calculo Tanga Estrecha

The Irs Paid 3 Billion In Interest To Taxpayers Because It Failed To Get Refunds Out On Time

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Do I Need To File A Tax Return Forbes Advisor

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Products Irs Interest And Penalty Software Timevalue Software